There central bank is issuing new $50 Billion notes. Unfortunately, that is enough to buy about 2 loafs of bread. Here is the full story via CNN.

Tweedle and the IASB Have Their Work Cut Out for Them

The International Accounting Standards Board, which is chaired by Sir David Tweedle, has come under scrutiny for bowing to political pressure from the European Union. The issue at hand is the method banks use to value their assets on the financial statements. Political interference in the accounting and financial sectors are nothing new in the US or abroad, but one of the key components of the IASB is supposed to be its ability to resist such political pressure.

Sir David, defended the boards decision even though his stated that it nearly led to his resignation. I am a big fan of the movement to International Accounting Standards, but I forsee such political pressure being a much larger issue then either the Securities Exchange Commission or the IASB has let on so far.

Here is the full story by Glenn Kessler courtesy of the Washington Post.

GM Fact of the Day

GM has 96,000 employees but provides health benefits to a million people.

from Mark Steyn via the National Review.

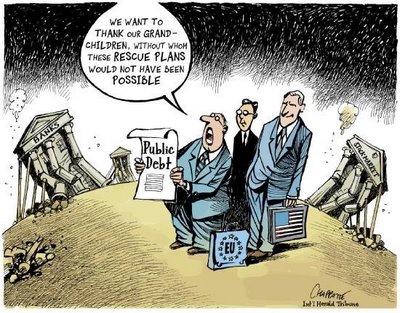

The Trueist Thing I Have Seen Today:

And The Economist Endorses…

The Best Line I Have Read About The Financial Crisis to Date: It’s in people’s minds.

From Yale economist Robert Shiller via Fox News:

Trillions in stock market value — gone. Trillions in retirement savings — gone. A huge chunk of the money you paid for your house, the money you’re saving for college, the money your boss needs to make payroll — gone, gone, gone.

Whether you’re a stock broker or Joe Six-pack, if you have a 401(k), a mutual fund or a college savings plan, tumbling stock markets and sagging home prices mean you’ve lost a whole lot of the money that was right there on your account statements just a few months ago.

But if you no longer have that money, who does? The fat cats on Wall Street? Some oil baron in Saudi Arabia? The government of China?

Or is it just — gone?

If you’re looking to track down your missing money — figure out who has it now, maybe ask to have it back — you might be disappointed to learn that is was never really money in the first place.

Robert Shiller, an economist at Yale, puts it bluntly: The notion that you lose a pile of money whenever the stock market tanks is a “fallacy.” He says the price of a stock has never been the same thing as money — it’s simply the “best guess” of what the stock is worth.

“It’s in people’s minds,” Shiller explains. “We’re just recording a measure of what people think the stock market is worth. What the people who are willing to trade today — who are very, very few people — are actually trading at. So we’re just extrapolating that and thinking, well, maybe that’s what everyone thinks it’s worth.”

Shiller uses the example of an appraiser who values a house at $350,000, a week after saying it was worth $400,000.

“In a sense, $50,000 just disappeared when he said that,” he said. “But it’s all in the mind.”

Here is the full article.

The Myth of John McCain’s “Budget Neutral” Health Care Plan

Vice Presidential Candidate Sarah Palin from last night’s debate:

He’s proposing a $5,000 tax credit for families so that they can get out there and they can purchase their own health care coverage. That’s a smart thing to do. That’s budget neutral. That doesn’t cost the government anything as opposed to Barack Obama’s plan to mandate health care coverage and have universal government run program and unless you’re pleased with the way the federal government has been running anything lately, I don’t think that it’s going to be real pleasing for Americans to consider health care being taken over by the feds. But a $5,000 health care credit through our income tax that’s budget neutral. That’s going to help

Immediately after hearing this statement, I sent the following text message to several of my peers: “somebody will have to explain the budget nuetral tax credit to me.”

The Tax Foundation has confirmed my skeptcism that John McCain’s plan is not tax nuetral. In fact, it will add $1.3 trillon to the deficit over 10 years.

To be fair, Senator Biden also made several mistakes and false claims.

See the full break down here.

Economy Got You Down: The Federal Reserve Has Your Cure

They have a few commercials that are designed to renew your confidence in the in the economy. I know I feel better after watching them. They are a bit subtle; in fact, you have probably seen them before. This one is my personal favorite:

This one isn’t bad either.

And for those of you keeping score at home, I ripped almost this entire post off from Tyler Cowen.

The 65 mpg Ford That You Can’t Get

Ford’s 2009 Fiesta ECOnetic goes on sale in European Markets in November, but it will be unavailable in the States. Ford’s reasoning is that Americans will not drive diesel-fueled vehicles because of both high fuel prices (taxes,) and stereotypes (diesel is for tractor-trailers and farmers,) not too mention American’s recent fascination with hybrid vehicles.

Here is the full story via Business Week.

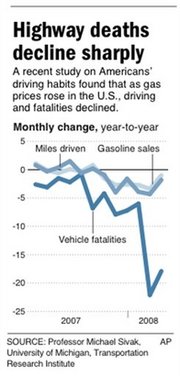

Another Benefit to High Gas Prices: Less Traffic Fatalities

A study conducted by Michael Sivak of the University of Michigan Transportation Research Institute concluded that traffic fatalities had a strongly inverse relationship to gas prices during the past year.

Should the March and April 2008 trends continue, the 2008 annual fatalities would drop under 40,000 for the first time in 1961.

Addendum: See my other two post about benefits of high gas prices here and here.